#Compound Interest Calculator

Explore tagged Tumblr posts

Text

Compound Interest Calculator | Easycompoundinterestcalculator.com

Take the guesswork out of your investment growth with our advanced Compound Interest Calculator. Whether you're planning for retirement, saving for a big purchase, or simply curious about how your money can grow, our calculator offers accurate, instant results based on your input. Visit EasyCompoundInterestCalculator.com to get started.

Compound Interest Calculator

0 notes

Text

Compound Interest Calculator A compound interest calculator is a simple tool designed to help you easily determine how your investments grow with time. It uses the power of compounding, helping you to understand how your principal amount starts earning interest and is then added back into your investment, leading you eventually to earn even more money. This compounding calculator allows you to make informed decisions with regard to your financial activities, whether

saving for retirement, planning a major purchase, or just curious about your investment growth. Use this tool by simply entering in your principal amount, rate of interest, and time period. You will see the total returns from your investments in just a few clicks. Use the calculator today to start maximizing your returns since it can easily calculate compound interest for you.

0 notes

Text

Power of Compound interest is interest that is applied to both the initial principle of an investment or loan and any accrued interest from previous periods.

0 notes

Text

Compound Interest Calculator - Grow Your Investments Faster

Use our Compound Interest Calculator to estimate your investment growth. Maximize your returns and plan your financial future. Try our free tool today!

0 notes

Text

0 notes

Text

Unveiling the Power of Compound Interest: Your Ultimate Compound Calculator Guide

Introduction: In the world of personal finance, understanding the impact of compound interest is crucial for making informed decisions about investments and savings. Whether you're planning for your retirement, setting aside money for a big purchase, or simply looking to grow your wealth, a compound calculator is an invaluable tool. Let's delve into the concept of compound interest and explore how a compound calculator can be your financial ally.

Understanding Compound Interest: Compound interest is the interest on a loan or deposit that's calculated based on both the initial principal and the accumulated interest from previous periods. In simpler terms, it's interest on interest. This compounding effect allows your money to grow exponentially over time, turning small investments into significant sums.

The Compound Calculator: A User-Friendly Guide: A compound calculator is a specialized tool designed to help individuals and investors predict the future value of their investments or savings, taking into account compound interest. Whether you're dealing with a one-time deposit, regular contributions, or varying interest rates, a compound calculator can provide you with a clear picture of your financial future.

How to Use a Compound Calculator:

Enter Initial Principal: Begin by inputting the initial amount of money you're investing or saving.

Set Interest Rate: Specify the annual interest rate applicable to your investment or savings account.

Choose Compounding Frequency: Decide how often the interest is compounded – annually, semi-annually, quarterly, or monthly.

Input Time Period: Enter the number of years you plan to keep your money invested or saved.

Additional Contributions (if any): If you're making regular contributions, include these in the calculator.

Benefits of Using a Compound Calculator:

Accurate Predictions: A compound calculator provides precise estimates of your future savings or investment value, helping you set realistic financial goals.

Informed Decision-Making: Armed with the knowledge of compound interest, you can make informed decisions about where to allocate your funds for optimal growth.

Goal Planning: Whether you're saving for a down payment on a house or planning for retirement, a compound calculator allows you to strategize and stay on track.

Conclusion: In the dynamic world of finance, harnessing the power of compound interest through a reliable compound calculator is a smart move. By understanding how your money grows over time, you can make strategic financial decisions that pave the way for a secure and prosperous future. So, plug in those numbers, explore the possibilities, and watch your wealth flourish with the magic of compounding.

0 notes

Text

Free Online ISA Calculator

Investment Amount (£): Investment Duration (Years): Annual Interest Rate (%): Calculate Returns Master Your Savings with Our Free Online ISA Calculator: A Step-by-Step Guide Welcome to our financial toolkit! Today, we’re thrilled to introduce our brand-new Individual Savings Account (ISA) Calculator, designed to empower you on your journey to financial freedom. Whether you’re a seasoned…

View On WordPress

#Best free online isa calculator#Cash ISA Calculator#compound interest calculator#Free Online ISA Calculator#help to buy isa calculator#interest rate calculator in months#ISA Investment calculator#Savings Calculator#simple interest calculator#simple interest emi calculator for bank staff#Simple Savings Calculator

0 notes

Text

Everything to know about gratuity and its calculation

Gratuity is a significant employee benefit that recognises years of service and loyalty towards an organisation. It serves as a gesture of appreciation and financial security for employees, especially when they retire or leave the company. Understanding how gratuity is calculated is essential for both employers and employees. Here is an extensive guide to gratuity, covering its definition, eligibility criteria, and the method for calculating gratuity.

By shedding light on this valuable aspect of employee compensation, you can make enlightened decisions regarding your financial future.

What is gratuity?

Gratuity is a statutory benefit provided to employees by their employers as a token of gratitude for their service. The Payment of Gratuity Act 1972 is responsible for its governance and applies to organisations employing 10 or more employees.

Gratuity eligibility

To be eligible for gratuity, you should have completed at least five years of continuous service with the employer. However, gratuity may be payable before five years in cases of death or disability of the employee.

Calculating gratuity

The formula for calculating gratuity is as follows:

Gratuity Amount = (Last drawn salary * 15/26) * (Number of years of service)

Here, the 'last drawn salary' refers to the basic salary and the allowance of the employee. Factor 15*26 is derived from 15 days of salary for each completed year of service, assuming a 26-day working month.

Importance of Gratuity Calculator

Calculating gratuity manually can be tedious, especially considering partial years of service. A Gratuity Calculator simplifies the process by providing accurate and instant results. Employees and employers can use online Gratuity Calculators to determine the amount quickly.

Tax implications

Gratuity is exempt from taxes up to a specific limit. For government employees, the entire gratuity amount is tax-free. For non-government employees covered under the Payment of Gratuity Act, the exempted amount is the following:

20 lakh

Actual gratuity received

15 days' salary for each completed year of service, based on the last drawn salary

Impact of compound interest

Employees can invest their gratuity to earn interest and secure their financial future. A compound interest calculator helps determine the potential returns on investments over time.

Conclusion

Gratuity is a valuable employee benefit that recognises loyalty and long-term service. By understanding how gratuity is calculated, employees can assess the financial benefits they may receive upon retirement or leaving their job. The importance of investing the gratuity amount wisely cannot be overstated. By using these calculators, you can explore investment options and secure your financial future with smart financial planning.

Overall, gratuity is a valuable financial cushion, fostering a sense of financial security and appreciation among employees for their dedicated service to their organisations.

0 notes

Text

How to Build Compound Interest Calculator App without Coding

Are you looking for a simple yet effective way to make money online? In this guide, I’ll show you how to create a Compound Interest Calculator application that works on both mobile phones and web browsers. You can monetize this tool using Adsterra, Google AdSense, AdMob, and other ad networks. By the end of this post, you’ll have a fully functional app and the knowledge to turn it into a passive…

0 notes

Text

Australian Compound Interest Calculator | Easycompoundinterestcalculator.com

Plan your financial goals with the Australian Compound Interest Calculator that reflects local banking and investment standards. Calculate potential returns with regular contributions and see how your wealth can grow in the Australian economy.

Australian Compound Interest Calculator

0 notes

Text

Compound Interest Calculator - Calculate Compound Interest Online in India

Compound Interest Calculator A compound interest calculator is a simple tool designed to help you easily determine how your investments grow with time. It uses the power of compounding, helping you to understand how your principal amount starts earning interest and is then added back into your investment, leading you eventually to earn even more money. This compounding calculator allows you to make informed decisions with regard to your financial activities, whether saving for retirement, planning a major purchase, or just curious about your investment growth. Use this tool by simply entering in your principal amount, rate of interest, and time period.

You will see the total returns from your investments in just a few clicks. Use the calculator today to start maximizing your returns since it can easily calculate compound interest for you.

What is a Compound Interest Calculator? A compound interest rate calculator or compound interest calculator is an online tool that helps you determine the potential earnings on an investment based on a set of parameters, such as the initial principal, the interest rate, and the compounding period. Most compound interest calculators use a simple interface that allows you to input the values, and then it does the calculations for you.

0 notes

Text

5 Effective Investment lessons by Top Investors

Value investing is a smart way to invest in stocks, it’s like buying something for less than its actual worth. This move protects your hard earned money from losing its value, even if the company isn’t doing as well as you expected it to perform, overtime, it leads to big profits because then money starts growing faster, this strategy focuses on investing in companies that are strong and have a good future.

Our top investors, time and again, from generations, have taught us the importance of investing and along with that some lessons that can help us from entering the market blindly to reduce the chances of major losses and to not treat it like a gambling game to in turn lose everything just because of impulsiveness.

Patience is the most important virtue, that everyone is well aware of, but are you patient enough to know some of the greatest lessons by the most important investment gurus Like sebi registered equity advisor.

Lesson 1: Risk comes from not known what you are doing — BY Warren Buffet

A majority of investors start trading in stocks without having a proper knowledge. of hoe these asset classes really work. Warren Buffet has time and again advised investors to avoid chasing everything that shines and focus on what they are able to understand.

Running after every trending business might lead to bigger losses and in turn lack of confidence in one’s knowledge and understanding. Buffet himself used this strategy where he stayed away from tech stocks and it was in 2016 when he truly understood the business and bought a stake in Apple,

Lesson 2: The earlier you start off on equities the better- BY Benjamin Graham

The sooner you start investing in equities the more time you have to earn returns. And the more time you have then more returns are earned by your returns.

This tactic is called the power of compounding, and that works perfectly in case of equities.

Lesson 3: Develop your judgement- Radhakishan Damani

Its might not be a very good trait to judge other people, but its most certainly acceptable to judge stocks. Equity investing is all about judging the market and developing a perspective. If you are unable to have an opinion of your own, then you can’t climb the ladder. Damani is good at judging the behavior of the stock prices and is a patient listener. He attends to the advice of everyone but acts according to his judgment and instinct of course the knowledge he has gained through years of experience in stock market

Lesson4: Adopt the theory of reflexivity- By George sorro

According to this theory, Investors’ perceptions of what is happening in the markets influence their actions, which in turn influences their perceptions

So basically George Sorro believes that market prices aren’t just based on facts and figures. People’s opinion and guesses about what will happen can also make prices go up and down, when prices change, it can affect people’s thoughts, and then those thoughts can make prices change again. This can cause markets too much or too little, showing that they might not always be perfect

Lesson 5: Be best friends with TIME

‘Compounding is a miracle. So, even the modest investments made in one’s early 20’s are likely to grow into staggering amounts over the course of an investment lifetime”- John Bogle

Bogle always advised investors to start investing as early as possible to become successful at investing. He was of the view that if you start early then u are allowing your returns to compound over time and your money can grow exponentially all by itself.

He has advised on trying to time the market and instead focus on long term investment, Bogle emphasized that spending time in the market is crucial for achieving investment success.

#sebi registered investment advisor#power of compound interest calculator#sebi registered stock advisory company#sebi registered equity advisor#share market advisor

0 notes

Text

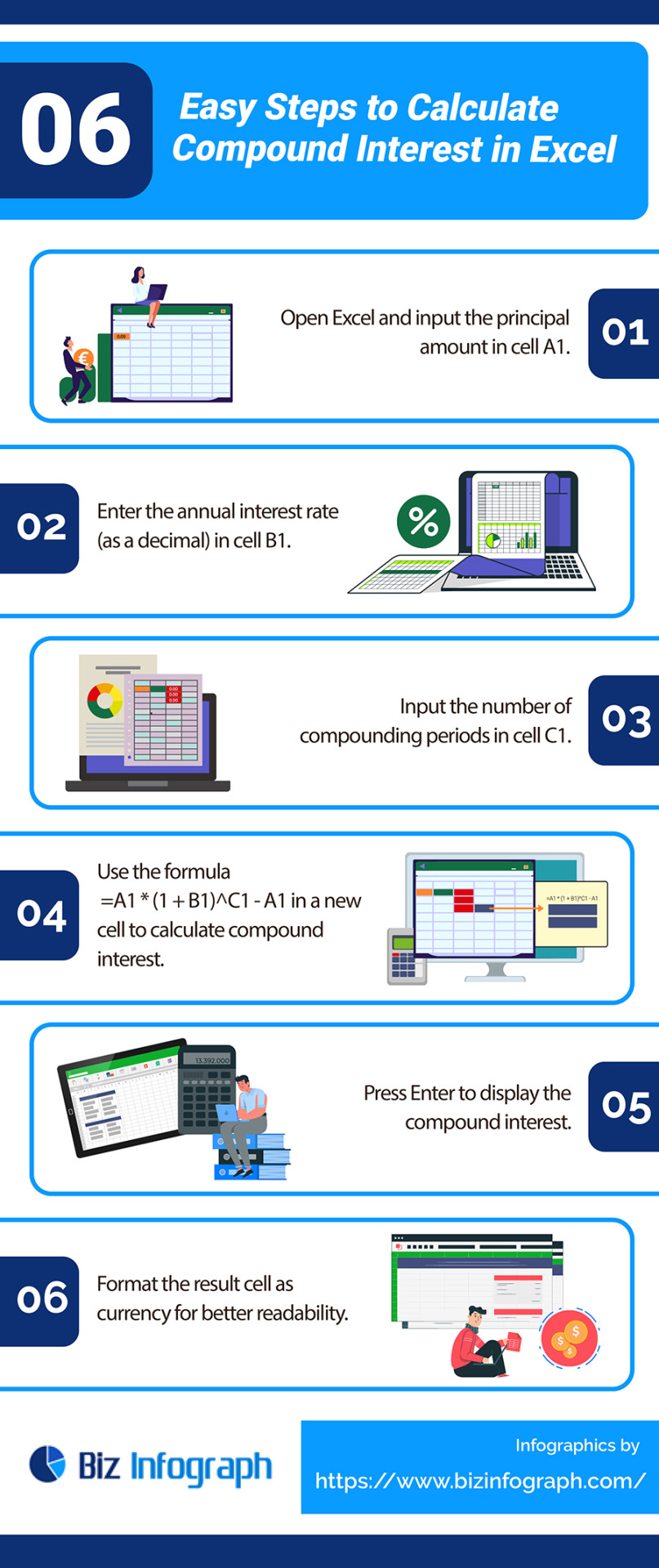

6 Easy Steps to Calculate Compound Interest in Excel

In particular, knowing how to calculate compound interest in Excel can be incredibly valuable to accurately and efficiently calculate complex financial projections, making their work more efficient and effective. To know more, read this infographic: https://www.bizinfograph.com/blog/steps-to-calculate-compound-interest-in-excel/

0 notes

Text

There are several perks and benefits of using compounding calculator. But it is important to use it in the best way possible. Keep reading.

#compounding calculator#compounding interest calculator#power of compounding calculator#daily compounding calculator

1 note

·

View note

Text

The Power of Modern Calculators: Tools for Financial, Health, and Planning Needs

In today's fast-paced world, access to accurate and efficient calculators is a necessity for making informed decisions in various aspects of life. Whether you're managing your finances, planning for the future, or tracking your health and fitness goals, modern calculators play a pivotal role. In this article, we will explore a range of online calculators provided by Modern Calculators, each designed to address specific needs and assist you in making well-informed choices.

1. Online Loan Calculators

Online Loan Calculators are invaluable tools for individuals seeking loans. These calculators help you estimate monthly payments, interest rates, and repayment schedules, ensuring that you choose the loan that best fits your financial situation.

2. Debt to Income Ratio Calculator

Managing your debt is crucial for financial stability. The Debt to Income Ratio Calculator allows you to determine your DTI ratio, aiding in better decision-making when it comes to taking on new debts.

3. Depreciation Calculator

For business owners and individuals with assets, the Depreciation Calculator is a valuable tool. It assists in understanding how assets depreciate over time, aiding in financial planning and tax considerations.

4. Discount Calculators

Whether you're a shopper or a business owner, Discount Calculators help you calculate discounts, savings, and final prices, ensuring you get the best deals.

5. Due Date Calculator

Expecting parents can rely on the Due Date Calculator to estimate their baby's due date based on various factors.

6. EER Calculator or Estimated Energy Requirement Calculator

Maintaining a healthy diet is easier with the EER Calculator. It helps you determine your daily calorie needs based on factors like age, gender, and activity level.

7. Future Value Calculator

Planning for retirement or long-term savings? The Future Value Calculator aids in estimating the future value of your investments, allowing you to set achievable financial goals.

8. Healthy Weight Calculator

Achieving and maintaining a healthy weight is essential for overall well-being. The Healthy Weight Calculator helps you determine a healthy weight range for your height.

9. Height to Waist Ratio Calculator

Assessing your health risks is made easier with the Height to Waist Ratio Calculator, which provides insights into your abdominal obesity risk.

10. Debt Consolidation Calculator

Those looking to simplify their debt repayment strategy can turn to the Debt Consolidation Calculator to explore consolidation options.

11. Home Loan Affordability Calculator

Before purchasing a home, use the Home Loan Affordability Calculator to determine what you can afford and avoid overextending your finances.

12. Home Loan Calculator with Down Payment

When buying a home, calculating the down payment is essential. The Home Loan Calculator with Down Payment simplifies this process.

13. Ideal Body Fat Percentage Calculator

Maintaining a healthy body composition is vital. The Ideal Body Fat Percentage Calculator helps you set realistic fitness goals.

14. Ideal Body Weight Calculator

Determine your healthy weight range with the Ideal Body Weight Calculator, making it easier to manage your weight.

15. Ideal Calorie Intake Calculator

Achieving your fitness goals requires a balanced diet. The Ideal Calorie Intake Calculator assists in determining your daily calorie needs.

16. Inflation Calculator

Planning for future expenses is essential. The Inflation Calculator helps you understand the impact of inflation on your finances.

17. Skipping Rope Calories Burned Calculator

Stay fit with the Skipping Rope Calories Burned Calculator, which estimates calories burned during jump rope workouts.

18. LDL Calculator

Monitor your cardiovascular health with the LDL Calculator, helping you understand your low-density lipoprotein levels.

19. Lean Body Mass Calculator

Fitness enthusiasts can track their progress with the Lean Body Mass Calculator, which calculates lean body mass and body fat percentage.

20. Loan Down Payment Calculator

Planning to buy a car or home? The Loan Down Payment Calculator helps you determine the down payment required for your purchase.

21. Loan Payments Calculator

Manage your loan repayment schedule efficiently using the Loan Payments Calculator.

22. Macronutrient Calculator

Tailor your diet to your nutritional needs with the Macronutrient Calculator.

23. Meal Calories Calculator

Keep track of your calorie intake with the Meal Calories Calculator, aiding in weight management.

24. Mortgage Payoff Calculator

Accelerate your mortgage repayment strategy using the Mortgage Payoff Calculator.

25. Conception Calculator

For those planning to expand their families, the Conception Calculator helps estimate conception dates.

26. One Rep Max Calculator or 1RM Max Calculator

Fitness enthusiasts can gauge their strength using the One Rep Max Calculator.

27. Ovulation Calculator

Couples trying to conceive can benefit from the Ovulation Calculator to determine fertile periods.

28. Savings Calculator

Whether you're saving for a rainy day or a specific goal, the Savings Calculator helps you track your savings progress.

29. SIP Calculator or SIP Return Calculator

Investment planning becomes more accessible with the SIP Calculator, allowing you to estimate returns on Systematic Investment Plans.

30. Period Due Date Calculator

The Period Due Date Calculator aids in tracking menstrual cycles and predicting due dates.

31. Personal Loan Calculator

Evaluate personal loan options efficiently with the Personal Loan Calculator.

32. Pregnancy Conception Date Calculator

Expecting parents can use the Pregnancy Conception Date Calculator to estimate conception dates.

33. Pregnancy Timeline Calculator

Monitor your pregnancy progress with the Pregnancy Timeline Calculator, providing insights into the stages of pregnancy.

34. Present Value Calculator

Financial planning often requires understanding the present value of future cash flows. The Present Value Calculator simplifies this calculation.

35. Real Estate Calculators

For property investors, the Real Estate Calculators offer valuable tools to assess property yield and rental returns.

36. Rent Calculator

Choosing between renting and buying a home is a significant decision. The Rent Calculator helps you analyze the financial aspects of renting.

37. Rent vs Buy Calculator

Make an informed decision about homeownership with the Rent vs Buy Calculator.

38. Rental Property Calculator

Property investors can assess the potential income from rental properties using the Rental Property Calculator.

39. Retirement Plan Calculator

Plan for your retirement with confidence using the Retirement Plan Calculator.

40. RMR Calculator or Resting Metabolism Calculator

Understand your basal metabolic rate with the RMR Calculator to optimize your calorie intake for weight management.

41. Return on Investment Calculator or ROI Calculator

Evaluate investment opportunities using the Return on Investment Calculator, ensuring your investments yield desirable returns.

42. Simple Interest Rate Calculator

Calculate the interest on loans or investments with the Simple Interest Rate Calculator.

43. Squat One Rep Max Calculator

Fitness enthusiasts can track their strength gains with the Squat One Rep Max Calculator.

44. Steps to Miles Calculator

Keep your fitness goals on track by converting your daily steps to miles using the Steps to Miles Calculator.

45. Student Loan Calculator

Plan your student loan repayment strategy with the Student Loan Calculator.

46. VO2 Max Calculator

Assess your cardiovascular fitness with the VO2 Max Calculator.

47. Waist to Hip Calculator

Monitor your waist-to-hip ratio, a key indicator of cardiovascular health, using the Waist to Hip Calculator.

48. Weight Gain Pregnancy Calculator

Expectant mothers can track their weight gain during pregnancy with the Weight Gain Pregnancy Calculator.

In conclusion, Modern Calculators provides a diverse range of online tools that cater to various financial, health, and planning needs. These calculators empower individuals to make informed decisions, manage their finances, and lead healthier lives. Whether you're a fitness enthusiast, a homeowner, or an investor, these calculators are valuable assets in your quest for success and well-being.

#bmi calculator#bmr calculator or basal metabolism calculator#alc calculator#amortization loan calculator#anc calculator#annual interest rate calculator#annualized percentage rate calculator#auto loan calculator#bench press one rep max calculator#refinance calculator#tdee calculator#body shape calculator#bsa calculator or body surface area calculator#business loan calculator#weight loss calculator#calories burned calculator#carbohydrate calculator or carb intake calculator#cash back or low interest calculator#compound investment calculator#compound Interest rate calculator#credit cards calculator credit cards payoff calculator#daily protein intake calculator#daily water intake calculator#deadlift one rep max calculator#debt consolidation calculator#debt to income ratio calculator#depreciation calculator#discount calculators#due date calculator#eer calculator or estimated energy requirement calculator

1 note

·

View note